japan corporate tax rate 2022

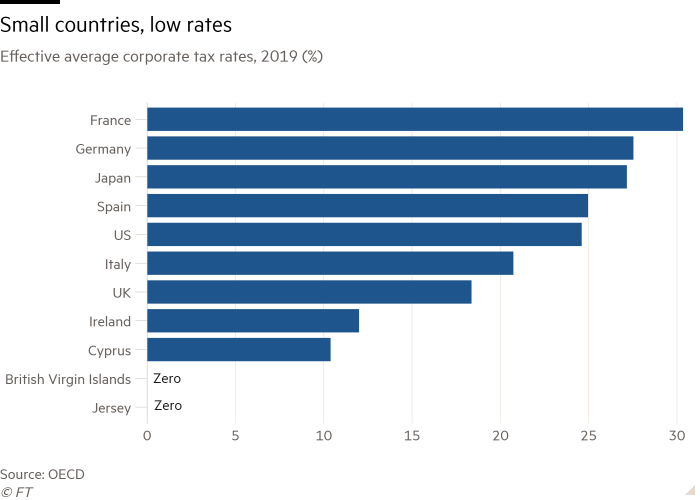

The local standard corporate tax rate in Japan is 234 and it applies to normal companies with a. Estimated effective tax rate including Local taxes In addition to National tax above local taxes are levied and the estimated effective tax rate for corporations in Japan is about 30 or less in.

Japan National Debt In Relation To Gross Domestic Product Gdp 2017 2027 Statista

When either of the aforementioned exceptions applies the capital gains are taxed at the general national corporation tax rate approximately 26 on a non-resident company or at 15315 on.

. Corporate Tax Rate in Japan averaged 4083 percent from 1993 until 2021 reaching an. Corporate Tax Rate in Japan remained unchanged at 3062 in 2022. Learn more about the Slovenian tax.

Puerto Rico follows at 375 and Suriname at 36. Japan Corporate Tax Rate Last Release Dec 31 2022 Actual 3062 Units In Previous 3062 Frequency Yearly Next Release NA Time to Release NA 2010 2013 2016 2021 30 36 42 Japan. Japans coalition leading parties released the 2022 tax reform outline the Outline on 10 December 2021.

Interest on corporate bonds issued by a Japanese company that is paid to a non-resident bondholder either a non-resident company or a non-resident individual is generally. Excluding jurisdictions with corporate tax rates of 0 the countries with the. Corporate Tax Rates 2022 includes information on statutory national and local corporate income tax rates applicable to companies and branches as well as any applicable branch tax imposed.

The corporate tax rate in Japan for a branch is the same as for a subsidiary. The local standard corporate tax rate in. Based on the Outline a tax reform bill the Bill will.

When weighted by GDP the average statutory rate is 2544. 23 the headline corporate income tax rate is 25 for financial sector companies Turkmenistan Last. Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020.

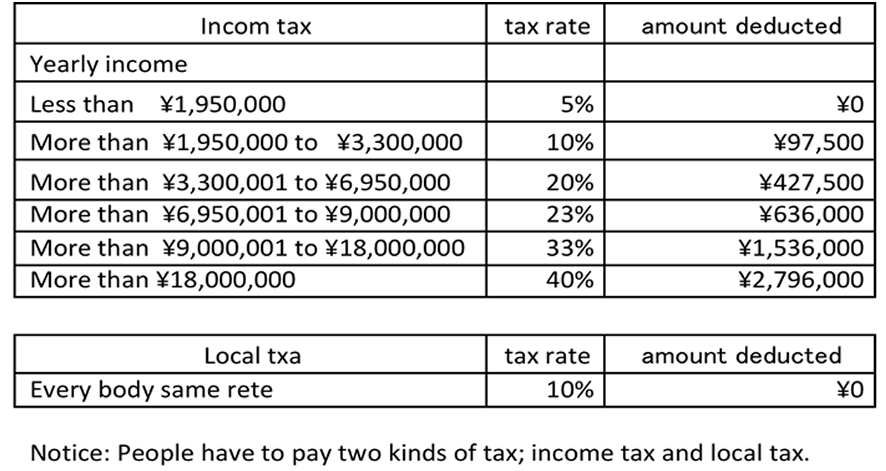

In the long-term the Japan Corporate Tax Rate is projected to trend around 3062 percent in 2022 according to our econometric models. 151 rows Japan Last reviewed 08 August 2022 232. If prefectural and municipal income taxes are not withheld by the employer they are to be paid in quarterly installments during the following year.

The combined nominal rate of corporation tax and local corporation tax national taxes is 2559 and the effective corporation tax rate national and local combined is. Jersey Channel Islands. The 2022 tax calculator for Japan will automatically calculate the appropriate income deductions for 2022 the calculations are then displayed with the results so you can understand how much.

For example the 2021 taxes are paid in four. Comoros has the highest corporate tax rate globally of 50.

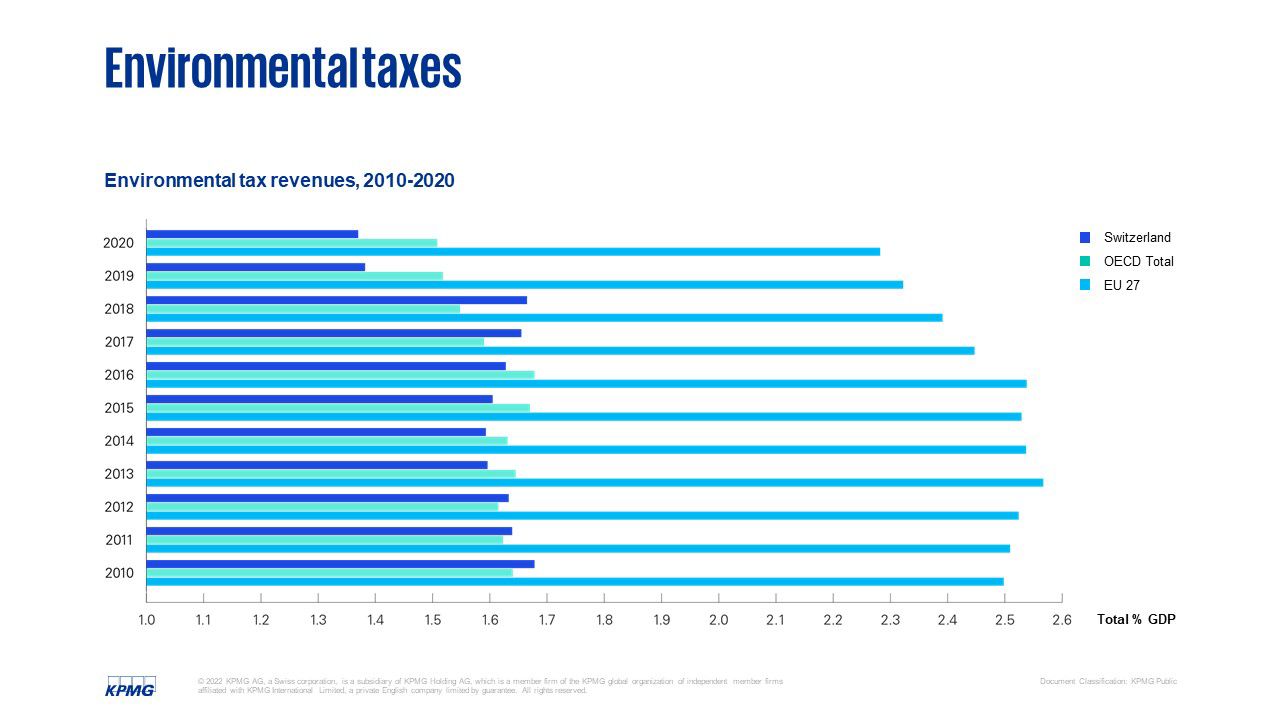

Kpmg Swiss Tax Report 2022 Kpmg Switzerland

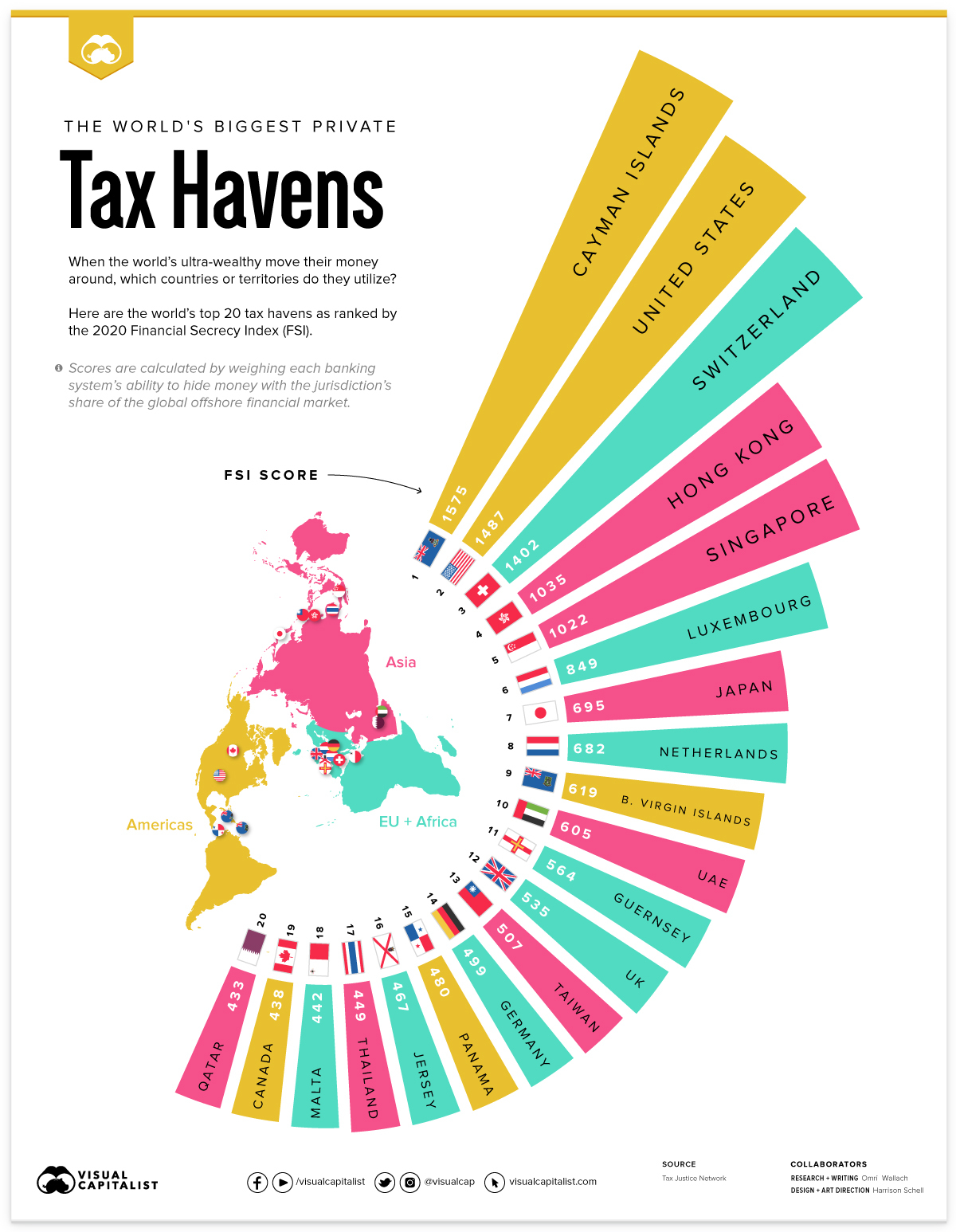

Mapped The World S Biggest Private Tax Havens In 2021

France Corporate Tax Rate 2022 Data 2023 Forecast 1981 2021 Historical Chart

Corporate Tax Rates Around The World Tax Foundation

Corporate Income Tax Return Filing In Japan Latest 2021 2022 Shimada Associates

Japan S Kan Seeks Corporate Tax Cut Wsj

15 Countries With The Highest Tax Rates In The World In 2022

Six Economic Facts On International Corporate Taxation

Japan Clears Way For Corporate Tax Cut Wsj

Corporate Tax In The United States Wikipedia

Corporate Tax 2022 Japan Global Practice Guides Chambers And Partners

Corporate Tax Rates And Economic Growth Since 1947 Economic Policy Institute

Taxing The Rich The Evolution Of America S Marginal Income Tax Rate Infographic

United States Federal Corporate Tax Rate 2022 Data 2023 Forecast

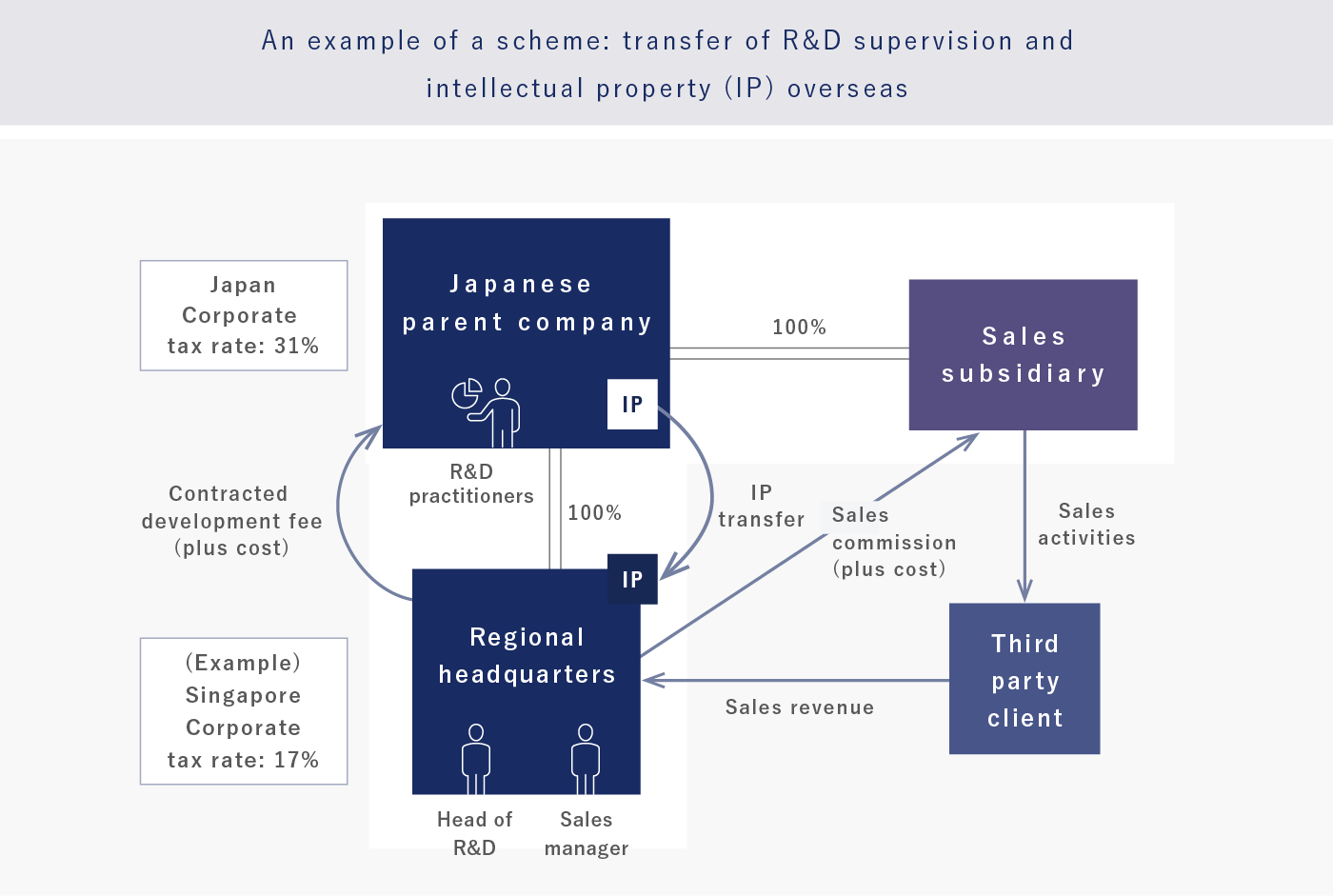

International Taxation Global Tax Planning Services Tokyo Kyodo Accounting Office Accounting Firm Where Accounting And Tax Professionals Gather

Profit Shifting Through Intellectual Property St Louis Fed

South Korea Cuts 2022 Growth Outlook Vows To Cut Corporate Tax Rate The Asahi Shimbun Breaking News Japan News And Analysis